B.39 Data Outlook: Enhancing Access for Climate Action

The thirty-ninth meeting of the Green Climate Fund (GCF) Board (B.39) is taking place in Songdo, Incheon, Republic of Korea, from July 15–18, 2024. This is my second Board meeting since joining the GCF Independent Evaluation Unit (IEU) last December. In this blog, I aim to provide insights from an IEU perspective, highlighting key topics, relevant to ongoing discussions and strategic decisions within the GCF.

The Updated Strategic Plan, 50by30 and Enhancing Access

This Board meeting is significant as it aligns with the newly approved GCF Strategic Plan for 2024–2027 (USP-2) from B.36. It also follows the Executive Director's vision that the GCF should efficiently and impactfully manage USD 50 billion by 2030. The USP-2 reflects the GCF's ambition to achieve stronger climate results through four strategic priorities: (1) empowering developing countries; (2) mobilizing the private sector; (3) improving access; and (4) protecting the most vulnerable. To support the achievement of these results, with a particular focus on the third priority, the IEU has produced an Access Synthesis Report that identifies existing challenges and obstacles faced by countries and accredited entities before providing recommendations for improving access to the Fund.

According to the Access Synthesis, as of May 2024, 69 out of 131 Accredited Entities (AEs) did not have any approved projects with the GCF. Further, there is a stark contrast between International Accredited Entities (IAEs) and Direct Access Entities (DAEs): 39% of IAEs do not have an approved funding proposal with the GCF, compared to 60% of DAEs. Recognizing the challenges faced by DAEs, the GCF aims to double the number of DAEs with approved GCF funding by 2027.

Portfolio Overview

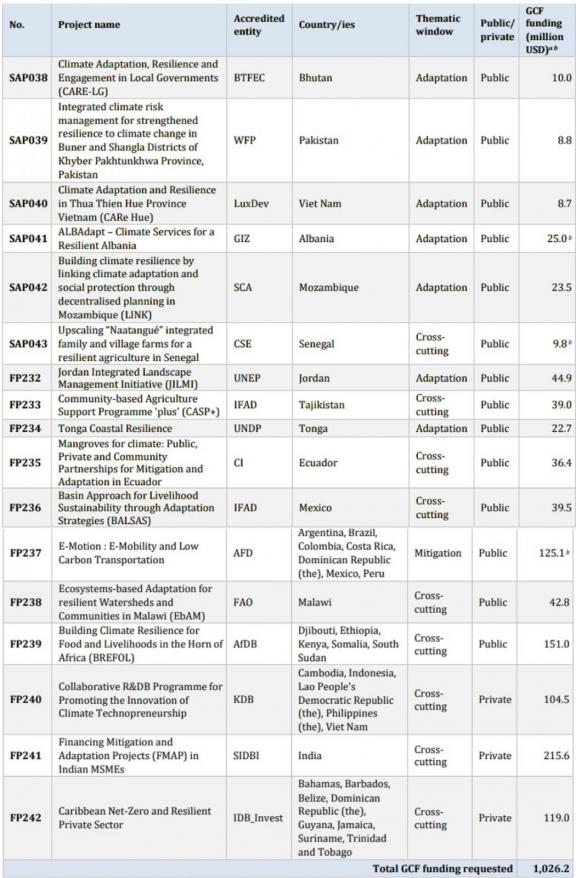

With these challenges and priorities in mind, we can analyze the funding proposals submitted for this Board meeting. A total of 17 projects have been proposed for B.39, requesting USD 1.03 billion, with a total value of USD 5.7 billion including co-financing. Of these, 13 are single-country projects, amounting to USD 527 million. Four projects, totaling USD 338 million, have received Project Preparation Facility support.

If all 17 funding proposals are approved, the GCF's total portfolio will expand to 270 projects, with a cumulative GCF funding amount of USD 14.95 billion and a total value of USD 58.67 billion including co-financing. This would bring the GCF's portfolio of approved projects to a stated estimated total reduction of 3,023.4 MtCO2eq in greenhouse gas emissions and potentially benefiting 1.1 billion people both directly and indirectly. It's important to note that these figures are based on estimates from the submitted funding proposals by AEs, and the actual outcomes will need to be independently evaluated later.

Table 1: Funding Proposals (FPs) to be considered at B.39

Source: GCF/B.39/02. Consideration of funding proposals.

The proposals cover a range of initiatives across multiple countries and thematic areas. Notably, three projects are from first-time accredited entities, including the Bhutan Trust Fund for Environmental Conservation (BTFEC), the Luxembourg Agency for Development Cooperation, and IDB Invest, the private sector institution of the Inter-American Development Bank Group.

The GCF aims to maintain a balanced distribution of funding over time, with 50% allocated to adaptation and 50% to mitigation. Additionally, it ensures that at least half of its adaptation funding is directed towards Least Developed Countries (LDCs), Small Island Developing States (SIDs), and African States. This thematic allocation highlights the GCF's focus on addressing the pressing adaptation needs of these regions.

When examining the portfolio of funding proposals submitted for this Board meeting by theme, 70% of funding is requested for adaptation projects, while 30% is directed towards mitigation projects in grant-equivalent terms. In line with GCF’s commitment to the most vulnerable countries, half of the adaptation funding (50%) is requested for LDCs, SIDs, and the African States. This thematic allocation highlights the GCF's focus on addressing the pressing adaptation needs of these regions.

Three Reflections from My Experience

In this blog, I will highlight three themes from the 17 funding proposals that resonate with my experiences over the past seven months at the IEU: (1) the crucial role of the private sector, (2) the importance of locally led adaptation efforts, and (3) the unique challenges of multi-country projects.

1. The Pivotal Role of the Private Sector in Mobilizing Climate Finance

The role of the private sector is fundamental in mobilizing climate finance, and this was evident during a recent impact evaluation design mission to Tanzania for FP179: Tanzania Agriculture Climate Adaptation Technology Deployment Programme (TACATDP). The TACATDP project, implemented by the CRDB Bank Plc, aims to provide Tanzanian farmers with innovative financial products to enhance climate adaptation in agriculture. Last August, the CRDB team travelled to Songdo, South Korea to join the annual impact evaluation design workshop held by the LORTA team. During the workshop, the team was introduced to various impact evaluation designs that would help them rigorously evaluate the TACATDP program. Since then, we held numerous online meetings to maintain our momentum. Then, in May, I finally visited Tanzania to engage on the ground and adapt the impact evaluation design to the local context. Working closely with the CRDB team, a private sector DAE, I witnessed firsthand the crucial role the private sector plays in developing and providing sustainable solutions through innovative and affordable financial products tailored to farmers’ needs.

The GCF’s USP-2 includes a goal to further engage the private sector by optimizing its risk appetite and flexible financing. In September 2021, the IEU's private sector evaluation highlighted the need for a country-driven approach in GCF’s private sector strategy and recommended prioritizing finance for micro, small, and medium enterprises (MSMEs). This is fully reflected in USP-2 which emphasizes engaging early-stage ventures and MSMEs, recognizing their critical role in climate action.

In line with the GCF’s strategy to further engage the private sector, three private sector projects are proposed for B.39, requesting USD 439 million, which constitutes 43 percent of the total. One of these proposals involves the Small Industries Development Bank of India (SIDBI), which aims to engage MSMEs, particularly for adaptation projects. From my perspective, this project is promising as MSMEs are generally closely integrated into their communities and possess local knowledge, making them well-suited for implementing community-based and context-specific climate solutions.

2. Spotlight on Locally-Led DAE Adaptation in Bhutan

Let's take a closer look at the project proposed by the Bhutan Trust Fund for Environmental Conservation (BTFEC), the only first-time DAE presenting a proposal at this Board meeting. Considering 60% of DAEs do not have any approved funding proposals, this is an exciting and promising step forward for DAEs seeking to access GCF financing. For the IEU, this project holds special significance as our team visited Bhutan last year for a country case study evaluating the GCF’s Readiness and Preparatory Support Programme.

The CARE-LG project, which seeks USD 10 million from the GCF through the Simplified Approval Process (SAP), is designed to help local governments incorporate climate resilience into annual planning and budget processes. Through performance-based grants, this project aims to promote effective, locally-led, and community-driven adaptation efforts that specifically address the unique needs of the last-mile population. One unique aspect of this project is the potential for these locally-led adaptation efforts to be sustained through the institutionalization of practices at the local level, which aligns with a key finding from the IEU’s evaluation of GCF’s adaptation portfolio.[1]

3. Multi-Country Projects: Navigating Challenges

It is noteworthy that four out of the 17 funding proposals are multi-country projects. The Independent Evaluation of the Relevance and Effectiveness of the Green Climate Fund's Investments in the African States found that single-country projects, as opposed to multi-country projects, involve greater country ownership since they focus on specific national priorities and needs. In contrast, multi-country projects often struggle to engage local stakeholders effectively in project design and implementation. From an evaluator’s perspective, multi-country projects present another unique challenge. The diverse nature of subprojects within a multi-country project makes them difficult to assess comprehensively as also highlighted in the IEU’s Second Performance Review. To ensure country ownership and accountability for GCF projects, these issues need to be addressed effectively.

Looking Ahead: Strategic Discussions and Decisions

As we approach B.39, the focus will be on how the GCF can enhance access and encourage strategic climate action. The discussions and decisions made during this meeting will be important in shaping the future of climate finance, ensuring that resources are effectively allocated to empower developing countries, mobilize the private sector, and protect the most vulnerable. The insights and recommendations from IEU evaluation will be instrumental in continuing to guide these efforts, ensuring that the GCF continues to fulfill its mission to lead a paradigm shift in climate action.

[1] The IEU’s Independent evaluation of the adaptation portfolio and approach of the Green Climate Fund recommends that the GCF should define the delivery of successful structures, systems and organizations as actual project impacts. https://ieu.greenclimate.fund/evaluation/adapt2021.