B.38 Data Outlook: Opening the GCF-2 with 11 Funding Proposals and Independent Evaluations

The thirty-eighth meeting of the Green Climate Fund (GCF) Board (B.38), set to take place in Kigali, Rwanda on 4–7 March 2024, represents an important milestone in global efforts to combat climate change. This will be my second Board meeting since I joined the GCF Independent Evaluation Unit (IEU) in August last year. As I revisit my experiences and observations from the previous Board meeting, I am filled with anticipation about the important discussions and decisions that lie ahead. To fully understand the significance of this meeting, I will delve into the documents submitted as agenda items, including evaluation reports from the IEU, in this blog.

First Board meeting of the new Strategic Plan period (2024–2027)

It is worth mentioning that this is the first Board meeting aligning with the period of the new GCF strategy (Strategic Plan for 2024–2027), which was approved last year at B.36. The IEU contributed to the GCF’s strategic planning by assessing the relevance and effectiveness of the Fund’s performance through the Second Performance Review, as well as by conducting an assessment of the Readiness and Preparatory Support Programme (RPSP), which is an important tool for direct access and programming.

The strategy established programming priorities, which include enhancing climate programming and direct access by improved access to the RPSP and maintaining the balance between mitigation and adaptation while supporting paradigm shift. The strategy also addresses urgent adaptation needs such as expanding the coverage of climate information and early warning systems, replicating innovative and inclusive approaches (i.e. seed capital, incubation for climate technologies, solutions based on local knowledge), and increasing the share of the Private Sector Facility. These priorities aim to build stakeholder capacities, facilitate paradigm shifts, and encourage green financing.

If you want a more practical perspective, see the Secretariat’s action plan for 2024 to operationalize the Strategic Plan, as well as the Board’s multi-year work plan aimed at ensuring GCF’s fulfilment of its mandate.

Funding proposals and projected GCF portfolio

While keeping the strategic programming priorities in mind, let’s have a closer look at the funding proposals that have been submitted for consideration at this Board meeting. A total of 11 projects have been proposed, amounting to USD 1,258.9 million, including USD 489.8 million that will be supported by the GCF.

Towards achieving goals for doubling direct access entities with approved projects

Among the 11 proposals, three projects stand out as they have been proposed by new direct access entities (DAEs). As of 31 of December 2023, the GCF partners with a network of 95 accredited entities (AEs) fully completed the accreditation process, with 38 international accredited entities (IAEs) that can operate globally and 57 DAEs that are based in specific regions or developing countries. Among the 95 AEs, 58 (28 IAEs, 30 DAEs) had been approved for GCF funded activities as of the end of 2023.[1]

The GCF has set a strategic goal to enable DAEs to directly access GCF funds and is aiming to double the number of DAEs with approved proposals by the year 2027. If the three new projects proposed by DAEs get approved at this Board meeting, it will be a promising step towards achieving this goal. Four of the projects submitted to this Board meeting have been supported by the Project Preparation Facility (PPF), including the three new DAE projects. Included in this FPs package for B.38 is the very first single-country project for the Cook Islands, which is being submitted through the country's first time DAE.

Table 1. Funding Proposals (FPs) to be considered at B.38

Source: GCF/B.38/02. Consideration of funding proposals.[2]

Projected portfolio if all FPs are approved: for what, where and how?

Assuming all 11 funding proposals are approved at the Board meeting, this would result in an increase of the total portfolio amount by approximately 3.5 per cent. This would then create a portfolio of 254 projects worth a total of USD 14 billion, and a total value of USD 53.1 billion including co-financing. It is interesting to ponder how this small 3.5 per cent increase differs from the overall portfolio composition. To understand this, we will examine which themes these projects fall into, which regions/priority groups they aim to target, and how the projects will be executed.

50:50 balance of adaptation and mitigation

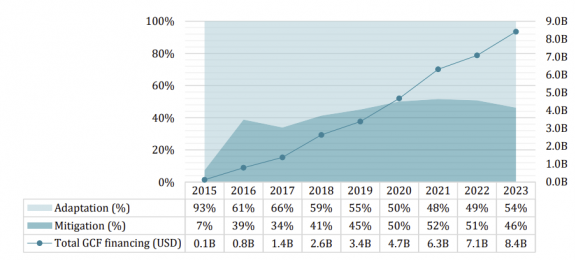

First, let's look at the ratio of adaptation and mitigation. The GCF aims to maintain a balance in funding between adaptation and mitigation, with an ideal ratio of 50:50. The projects proposed this time have a similar proportion, with 55 per cent (USD 270.5 million) for adaptation and 45 per cent (USD 219.2 million) for mitigation (note that this is based on nominal US dollars). If all are approved, the total portfolio will have USD 4 billion (46 per cent) allocated to mitigation and USD 4.7 billion (54 per cent) to adaptation (this is calculated in grant equivalent). Figure 1 shows that the GCF has been maintaining its balance of adaptation and mitigation since 2019.

Figure 1. Balance of adaptation and mitigation funding over time (in grant equivalent terms)

Source: GCF/B.38/Inf08. Status of the GCF portfolio: Approved projects and fulfilment of conditions.

If all projects are approved, the portfolio will comprise 110 adaptation projects, 68 mitigation projects, and 76 cross-cutting projects. With this portfolio, the GCF expects to reduce greenhouse gas emissions by 3.0 GtCO2eq, and the beneficiaries are expected to number approximately 1,108.2 million.

A floor of 50 per cent of adaptation allocation to vulnerable countries

The GCF has set a goal to deliver minimum 50 per cent of the allocated adaptation funds to vulnerable countries: the group of countries particularly vulnerable to the adverse effects of climate change considering their urgent and immediate needs, including small island developing States (SIDS), least developed countries (LDCs) and African States.

This time, seven out of the 11 projects target these vulnerable countries, totaling USD 211.8 million (43 per cent of the total requested GCF funding amount). The requested GCF funding amount of the adaptation allocation for vulnerable countries will be USD 130.4 million (48 per cent). If all these projects are approved, 171 out of the total 254 projects will be entirely or partially targeted at LDCs, SIDS and/or African States, with the GCF funding amount of the adaptation allocation for vulnerable countries standing at USD 3.1 billion (66 per cent) in grant equivalent terms.

In terms of regions, this FP package has a high proportion of projects in the Asia Pacific region (49 per cent) and Eastern Europe (10 per cent). The overall GCF portfolio has the most projects in Africa (USD 5.3 billion, 38 per cent), followed by Asia (USD 4.8 billion, 34 per cent), Latin America (USD 3.4 billion, 24 per cent), and Eastern Europe (USD 490.6 million, 4 per cent).

Composition of public/private, financial instruments

The GCF employs a range of financial instruments to respond to climate change. The projects proposed this time comprise six public sector proposals, requesting GCF funding of USD 330.5 million (67 per cent) and five private sector proposals, requesting GCF funding of USD 159.2 million (33 per cent). If all are approved, in the entire portfolio the public sector will account for USD 9 billion (64 per cent), and the private sector will account for USD 5 billion (36 per cent), similar to the proportions in the proposed projects.

Grants make up the largest part of the financial products of the proposed projects at 47 per cent, followed by loans at 37 per cent, and equity at 16 per cent. If all these projects are approved, the GCF portfolio will consist of grants (USD 5.8 billion or 42 per cent), loans (USD 5.6 billion or 40 per cent), equity (USD 1.6 billion or 12 per cent), result-based payments (USD 496.7 million or 3 per cent) and guarantees (USD 361.5 million or 3 per cent).

What can we gain from independent evaluations?

At this Board meeting, two independent evaluation reports from the IEU will be presented. These are the final evaluation report on the GCF’s energy sector portfolio and approach and the final evaluation report on the Fund’s investment framework. As the Fund enters a new strategic period (2024–2027), these evaluations will hopefully guide the Board and the GCF in making choices that will help achieve the strategic plan and maximize investment impact.

‘Independent Evaluation of the Green Climate Fund’s Energy Sector Portfolio and Approach’

The IEU conducted an independent evaluation of GCF’s energy sector portfolio and approach. It found that GCF’s approach to the energy sector is assisting country-led interventions and provides the most support for energy generation and access. Energy has the largest share of all GCF result areas in terms of both in financing and number of projects and the effects of the projects affect both adaptation and mitigation efforts.

Promising signs of paradigm shifts towards low-carbon energy solutions in these countries have been observed, such as improving energy accessibility, building an institutional framework for energy generation, and changing the solar energy market. Positive results have emerged from innovative business models and initiatives designed to promote energy savings within the renewable energy sector.

The evaluation report says, in the future, the GCF needs to set clear expectations for the role and objectives of its energy sector approach. It also needs to increase support for the sector’s regulatory framework and institutional capacity. The report suggests it is necessary to develop a comprehensive approach to energy investment that considers demand-side measures such as energy efficiency, innovative energy technologies such as offshore wind, green hydrogen and energy storage and new ways of extending GCF’s reach to vulnerable countries.

‘Independent Evaluation of the Green Climate Fund’s Investment Framework’

The IEU also conducted an independent evaluation of the GCF’s investment framework. This evaluation assessed the relevance and effectiveness of the GCF’s investment framework in conjunction with the GCF's objectives. It assessed investment priorities, coherence with other policies, and efficiency with funding proposals. This evaluation found that the investment framework is an effective instrument for guiding the GCF in executing its mandate.

According to the evaluation, further work needs to be done. While removing certain redundant or repetitive framework elements, there is room for improving the articulation of the framework itself. Accounts of the risks that the GCF is willing to take may also be included in the investment framework. It is also necessary for the GCF to harmonize its results measurement methodology. As it stands, there are certain similarities between the way the GCF measures results and the perception of GCF investments, but they do not entirely match, and this gap needs to be addressed. Most notably, complementarity and coherence should be examined more closely, according to the evaluation.

Launching the third performance review of the GCF

It is worth mentioning that IEU will propose at B.38, the launch of the third performance review of the GCF. Some may consider it too early to launch the third performance review when GCF-2 is only just starting. This is not the case, as the GCF is set to initiate the third replenishment 30 months after the commencement of GCF-2, with the replenishment expected to begin in mid-2026. The Board has decided to review the GCF Strategic Plan ahead of each replenishment process to revise the strategic vision and update objectives and priorities. The third performance review (TPR) will be planned in 2024 and conducted through 2025 and 2026. The final evaluation report will be delivered in 2027.

This Board meeting is a crucial juncture for the GCF to make a sound start to the GCF-2 strategic period. It will play a vital role in expanding the GCF’s project portfolio through the approval of a diverse range of project proposals, and it will be the space for discussion of the GCF’s strategic direction through the insights gleaned from the abovementioned independent evaluation reports.

Throughout 2024, the IEU will continue to support the decision-making of the GCF by providing credible evaluation evidence on the performance of the Fund. The 2024 evaluations will include: (i) Independent evaluation of the GCF’s approach to Indigenous Peoples; (ii) Independent evaluation of the relevance and effectiveness of GCF’s investments in the Latin America and the Caribbean (LAC) States; (iii) Independent evaluation of the result area Health and Well-being, Food and Water Security; and (iv) Independent evaluation of the GCF’s approach to whistleblowers and witnesses.

The IEU, through its rigorous, evidence-rich evaluations, will continue to enable informed discussion among the GCF Board, the Secretariat and other stakeholders and policy decisions that allow GCF to fulfill its strategic goals and achieve optimal investment impact.

Endnotes

[1]GCF/B.38/03 Consideration of accreditation proposals. Specific figures for IAE and DAE are sourced from the GCF portfolio management system known as IPMS.

[2]1 Note that FP031 was not submitted; FP032 was withdrawn; FP055 and FP057 were not approved by the Board; approval of FP029 lapsed on 23 October 2017; approval of FP030 lapsed on 28 July 2018; approval of FP006 lapsed on 26 September 2018; FP079 and FP088 (currently FP110) were withdrawn by the accredited entity; approval of FP054 lapsed on 27 June 2019; approval of FP065 lapsed on 16 February 2020; FP123 was withdrawn by the accredited entity; approval of FP038 lapsed on 13 June 2020; approval of financing for the European Investment Bank implemented part of FP026 lapsed on 13 June 2020 (the technical assistance component of FP026 is unaffected and its implementation by Conservation International continues); and approval of FP104 lapsed on 13 February 2021. Accordingly, this results in 243 approved proposals – 188 public sector and 55 private sector – as at 11 February 2024. Abbreviations: Acumen= Acumen Fund, Inc., ADB= Asian Development Bank, CCCCC= Caribbean Community Climate Change Centre, COFIDES= Compañia Española de Financiación del Desarrollo, Ecobank= Ecobank Ghana Limited, DAE = direct access entity, GIZ= Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, IAE= international access entity, IFAD= International Fund for Agricultural Development, KDB= Korea Development Bank, MFEM_COK = Ministry of Finance and Economic Management (MFEM) of the Government of Cook Islands, SCA= Save the Children Australia, SIDBI= Small Industries Development Bank of India, SPC= Pacific Community. a The individual funding amounts are rounded to the nearest tenth; therefore, the total may not be the exact sum of these numbers owing to rounding in the document. b The requested GCF amount in euros is converted into United States dollars at the United Nations Operational Rates of Exchange effective as at 1 February 2024 (EUR 1 = USD 1.08459870).