B.37 Data Outlook: funding proposals for the board’s consideration

Tbilisi, Georgia’s national capital, will be the centre of global attention as the Board Members of the Green Climate Fund (GCF) – the world’s largest dedicated multilateral climate fund – convene for deliberations as part of its Thirty-Seventh Meeting of the GCF Board (B.37), from 23 to 25 October. This meeting follows B.36, which took place in Songdo, South Korea in July 2023 and saw the GCF Board’s approval of the GCF Strategic Plan 2024 – 2027, ushering in its Second Replenishment period (GCF-2). Featuring prominently on the agenda of B.37 will be the adoption of the final report of the Independent Evaluation of GCF’s Readiness and Preparatory Support Programme (RPSP2023), amongst a host of crucial items.

Ahead of B.37, which marks my second GCF Board meeting to observe since joining the GCF and the first that I will be following virtually from the G-Tower in Songdo, South Korea, I take a moment to reflect on a few very important questions pertaining to the GCF portfolio. How will the GCF’s projected portfolio look like post-B.37, and what will be its potential implications for vulnerable countries, including the small island developing States (SIDS), the least developed countries (LDCs), and particularly African States? To answer these questions, I will analyze the GCF portfolio and draw upon the GCF’s policies, GCF Secretariat documents to the Board, and some findings from the IEU’s independent evaluation reports.

What will be the GCF’s projected overall portfolio post-B.37?

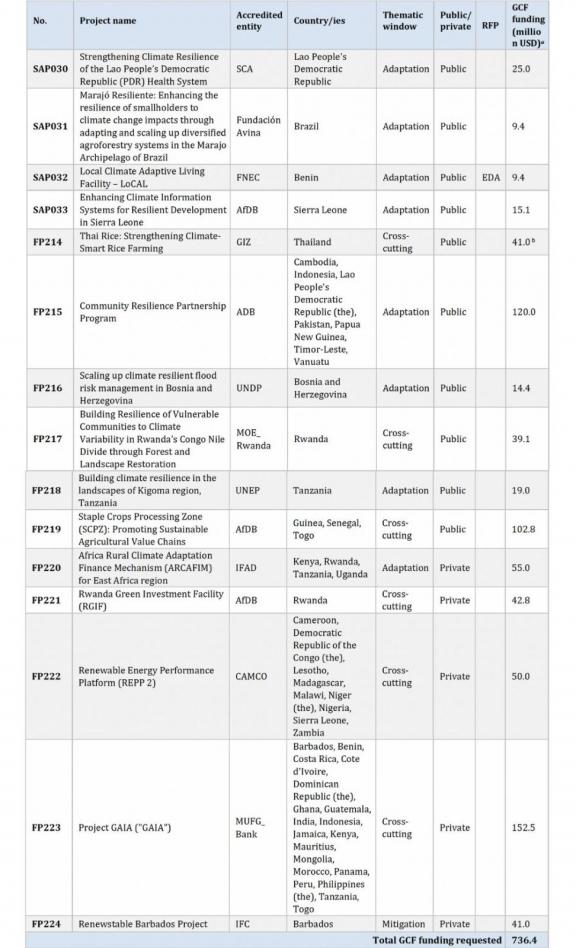

The GCF Secretariat will table 15 new projects for the Board’s consideration and decision at B.37 (See Table 1). If approved by the Board at B.37, these new funding proposals are expected to expand the GCF’s aggregate portfolio by USD 736.4 million or USD 3,607.3 million, including co-financing, in nominal terms. This will result in a GCF aggregate portfolio of USD 13.5 billion or USD 51.8 billion, including co-financing, with 243 projects and programmes.

Table 1: List of funding proposals (FPs) submitted for consideration at B.37

Source: GCF/B.37/02: Consideration of funding proposals

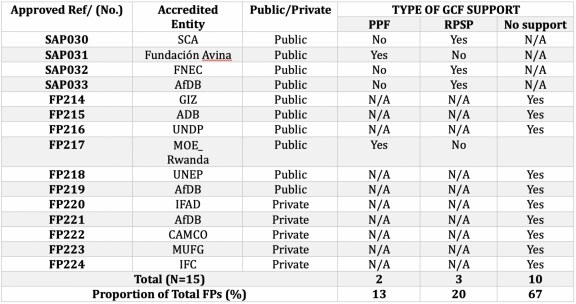

What kind of support – i.e., Private Sector Facility (PPF) or Readiness and Preparatory Support Programme (RPSP) - did the entities receive from the GCF in the preparation and submission of their Funding Proposals (FPs)?

The greatest proportion of the 15 FPs was prepared and submitted for GCF funding without any form of prior support from the GCF. Also,10 of these FPs (or 67 per cent) received neither PPF nor RPSP support from the GCF, while 3 FPs (or 20 per cent) and 2 FPs (13 per cent) were supported through RPSP and PPF respectively (Table 2).

Table 2. Type of Support Received by Entities from GCF

Source: FPs Submitted for Consideration at B.37 GCF Board Meeting

NB: ‘N/A’ in the table means a specific response is not applicable to the FP in question.

Also noteworthy is the difference between private and public sector entities in terms of representation as all the 5 entities that received GCF support in their project development and preparation are public sector entities. None of the five private sector entities represented among the B.37 FPs received GCF support. The source of project development and preparation support these private sector entities may have received elsewhere, as well as the reason for such limited number of FPs submitted by them call for further scrutiny.

This observation is in sync with findings from the IEU’s RPSP2023 evaluation, which established that the GCF and particularly the RPSP process are widely perceived to be ill-suited to the private sector and also the intermediary organizations. Although its private sector engagement continues to evolve and grow, there is a lack of mechanisms and means to significantly catalyze private sector participation. As a result, it has witnessed limited engagement of non-state actors including the private sector entities.

The IEU, amongst others, recommends in the RPSP2023 evaluation that the socialization of the readiness programme needs to improve, through very intentional and targeted communication of its programmatic offerings and lessons learned so far (RPSP2023). This will help address the country-level private sector actors’ lack of information and raise awareness on how to engage with and benefit from the GCF’s readiness resources at the national level.

Will the GCF get closer to achieving a 50:50 balance between adaptation and mitigation post-B.37?

The GCF’s Governing Instrument, Strategic Plan, and Investment Framework all speak about the Fund’s aim to achieve a 50:50 balance between mitigation and adaptation over time, in grant-equivalent terms, in its portfolio. This aspiration is aligned with the recognized importance of pursuing a paradigm shift and a transformational change towards low-carbon and climate-resilient development pathways in developing countries. Yet, the findings of the IEU’s Second Performance Review of the GCF (SPR2023) indicate that the GCF’s portfolio tilts favourably towards mitigation with comparatively limited adaptation investment.

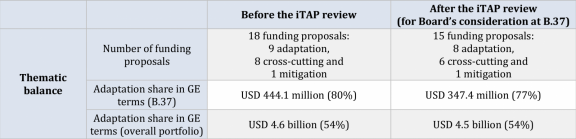

This imbalance is projected to persist post-B.37, but the good news is that it will weigh more strongly towards adaptation if all funding proposals tabled are approved by the Board. Out of the 15 funding proposals, adaptation has the highest share, accounting for 8 projects, followed by 6 cross-cutting projects and one mitigation project (See Table 3). On a thematic nominal basis, this represents USD 512.8 million (70 per cent) for adaptation and USD 223.6 million (30 per cent) for mitigation [1]

Cumulatively, the GCF’s adaptation portfolio will stand at 104 projects, 67 mitigation projects, and 72 cross-cutting projects post-B-37, if all FPs were to be approved. In nominal terms, mitigation allocation is expected to dominate the projected composition of the overall GCF portfolio, representing 56 per cent (USD 7.6 billion) and 44 per cent (USD 5.9 billion) for adaptation. However, in grant equivalent terms, the adaptation allocation constitutes a more significant portion with a total funding of 4.5 billion (54 per cent) and USD 3.9 billion (46 per cent) for mitigation, representing a 2 per cent increase for the former and a 2 per cent decrease for the latter compared to the B.36 portfolio [1] [2]. In one breath, this may be seen as a positive sign of gains toward achieving a 50:50 balance between mitigation and adaptation. But on the other hand, the lack of parity in increments between Board meetings raises questions about its long-term sustainability.

Table 3: Thematic composition of B.37 funding proposals in relation to GCF aggregate portfolio

Source: (GCF/B.37/02, Paragraph 8).

What will be the GCF’s portfolio outlook by Sector (private vs. public) post-B.37?

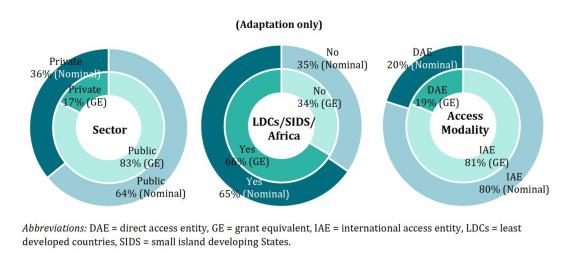

Regarding the overall GCF portfolio, the portfolio continues to weigh favourably towards public sector projects. Of the 15 FPs submitted for approval at B.37, public sector proposals constitute the highest number, accounting for 10 FPs, requesting USD 395.1 million (54 per cent), with only 5 private sector proposals, requesting USD 341.3 million (46 per cent) of GCF funding [1]. This translates into the overall GCF portfolio of USD 8.6 billion (64 per cent) requested by public sector projects and programmes, and USD 4.8 billion (36 per cent) by private sector projects and programmes in nominal terms. In grant equivalent terms, the GCF resources allocated to public sector projects will stand at USD 6.9 billion (83 per cent), while the private sector allocation will stand at USD 1.5 billion (17 per cent) post-B.37 (see Figure 1).

Figure 1: GCF funding amount by Sector, vulnerable countries (adaptation only), and entity type

Source: (GCF/B.37/02, Paragraph 29).

Will the International Accredited Entities (IAE) continue its dominance in the GCF portfolio, post-B.37?

The International Accredited Entities (IAEs) are projected to maintain their usual dominance in the GCF’s aggregate portfolio on a nominal and grant equivalent basis post-B.37, if the Board approves all the FPs. At B.37, 12 projects requesting USD 678.6 million in nominal terms (92 per cent) are expected to be channeled through IAEs, and only 3 projects requesting USD 57.8 million (8 per cent), through national and regional Direct Access Entities (DAEs), respectively [1].

Moreover, the IAE dominance holds true for the aggregate GCF portfolio as well. In nominal terms, USD 10.8 billion (80 per cent) of GCF funding, representing 186 projects, will be channeled through IAEs, while the remaining 20 per cent (USD 2.8 billion) of 57 projects will be channeled through DAEs. Similarly, USD 6.8 billion (81 per cent) and USD 1.6 billion (19 per cent) of GCF funding, in grant equivalent terms, will be channeled through IAEs and DAEs, respectively (See Figure 1). The dominance of IAEs reconfirms the findings of the IEU’s Independent Synthesis of Direct Access in Green Climate Fund (DA2022), which revealed that of the 200 GCF-approved projects as of B.33, only 24 per cent constituted DAE projects (26 national-DAE projects and 21 regional-DAE projects), while the remaining 66 per cent was claimed by IAEs. In addition, few GCF support-eligible countries have DAEs with even fewer having DAE projects (DA2022).

If this trend goes unreversed, it risks significantly undermining the GCF’s goal of increasing funding channeled through DAEs, compared to the IRM and GCF-1 period outlined in its Strategic Plan. Against this backdrop and in the context of various hindering factors at the GCF- and national- and entity-level, the IEU recommended that GCF ease direct access through different project approval channels, including the simplified approval process (SAP) to better reach a wider range of institutions.

How is B.37 expected influence the diversity of GCF’s financing instruments?

According to SPR2023, GCF’s financing instruments are inadequately diverse enough, leaning predominantly towards loans and grants. This unequal distribution of financing instruments is not expected to reverse course post-B.37, as grants are set to constitute the largest share of GCF’s projected portfolio composition, representing USD 5.6 billion (42 per cent), followed by loans (USD 5.5 billion, or 40 per cent), equity (USD 1.6 billion, or 12 per cent), results-based payments (USD 496.7 million, or 4 per cent), and guarantees (USD 361.5 million, 3 per cent) [1].

What does the projected B.37 GCF portfolio mean for vulnerable countries such as the LDCs, SIDs, and particularly the African States?

Vulnerable countries, particularly the LDCs, SIDs, and African States, are given special consideration in GCF’s programming priorities given their urgency and need for adaptation finance. The GCF aims for a floor of 50 per cent of the adaptation finance to be channeled to these countries, while striving to build on its initial resource mobilization (IRM) and GCF-1 outcomes. In this regard, B.37 brings good news as vulnerable countries stand to be the biggest winners if all 15 funding proposals are approved in terms of their share in the approved GCF portfolio and adaptation allocation. For B.37, 12 out of 15 FPs either wholly or partly target the LDCs, SIDs, and/or African States with a total funding of USD 571.3 million, accounting for 78 per cent of the total requested GCF funding amount. Also, in terms of the overall GCF portfolio, 164 projects and programmes out of 243 approved FPs (representing about 67 per cent) will target, wholly or partly, the LDCs, SIDs, and/ or African States [1]. The requested GCF funding amount of the adaptation allocation for vulnerable countries will be 66 per cent (USD3.0 billion) and 66 per cent (USD 3.9 billion) in grant equivalent and nominal terms respectively (See Figure 1 above).

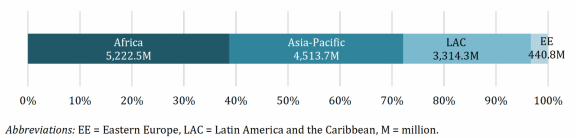

In terms of geographical coverage and balance, based on the B.37 forecast, Africa stands to be the greatest beneficiary with the largest share of the aggregate GCF portfolio with USD 5,222.5 million (38 per cent), followed by the Asia-Pacific with USD 4,513.7 million (34 per cent), Latin America and the Caribbean with USD 3,314 million (24 per cent), and Eastern Europe with USD 4408 million (4 per cent), as seen in Figure 2 below.

Figure 2: Projected Regional Distribution of GCF funding portfolio

Source: (GCF/B.37/02, Paragraph 18).

Notwithstanding this positive outlook for the African states and the GCF being their largest multilateral climate finance contributor between 2015 and 2022, the continent still faces significant obstacles in accessing climate finance commensurate with its climate urgency and needs, as per the findings of the Independent evaluation of the relevance and effectiveness of the GCF’s investments in African States (AFR2022). One of the most important challenges lies with the fact that the amount of available funds falls short of the estimated climate finance needs and the USD 100 billion annually (extended to 2025) pledged by developed countries (Ibid).

Even so, there is an asymmetry in GCF’s investments in Africa across adaptation and mitigation. Current GCF investments in African States are skewed towards mitigation, despite the African States calling for a shift towards adaptation finance amidst the continent’s current climate crises and the continent’s relatively minor roles as a greenhouse gas emitter. According to the AFR2022 evaluation, mitigation constituted 59 per cent and adaptation 41 per cent of the approved GCF finance for the African States with this imbalance remaining unaltered year-by-year.

The comparatively limited adaptation investment in Africa is also counter-intuitive in the context of existing evidence on the continent’s paradigm shift and transformational change potential. As findings from the IEU’s working paper ‘Likelihood for Transformational Change at the Green Climate Fund’ point out, adaptation investment in Africa has a comparably higher impact potential in terms of transformation and paradigm shift impact than other world regions.

In conclusion, the preceding analysis does point out a raft of limitations and obstacles standing in the way of vulnerable countries’ access to climate finance. However, it also highlights historic achievements and continued efforts of GCF as the world’s largest multilateral climate fund in advancing a paradigm shift and a transformational change towards decarbonization and climate-resilient development pathways in developing countries. So, as I draw the curtain on this blog, I wish the GCF Board fruitful B.37 deliberations as they navigate the slippery line in balancing the diverse stakeholder interests and trade-offs in reaching decisions on the many critical items on the B.37 agenda.

Documents consulted:

[1] Green Climate Fund (2023). GCF/B.37/02: Consideration of funding proposals. Retrieved from https://www.greenclimate.fund/document/gcf-b37-02

[2]. Green Climate Fund (2023). GCF/B.36/02: Consideration of funding proposals. Retrieved from https://www.greenclimate.fund/document/gcf-b36-02

Disclaimer: The views expressed in blogs are the author's own and do not necessarily reflect the views of the Independent Evaluation Unit of the Green Climate Fund.