B.31 Data Outlook: Funding proposals for Board’s consideration and relevant highlights from IEU evaluations

The GCF strives towards achieving the ultimate objective of the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement. It promotes the paradigm shift towards low-emission and climate-resilient development pathways. To achieve this ambition, the GCF Board meets three or four times per year to approve funding in line with the Fund’s principles, criteria, modalities, policies and programmes and to approve the Fund’s operational modalities, access modalities and funding structures, among other things. The 31st meeting of the GCF Board (B.31) is scheduled to take place from 28 to 31 March 2022; as of 22 March, three projects are lined up for the Board’s consideration and approval at B.31. This blog presents a synopsis of what the GCF’s overall portfolio would look like if the three projects are to be approved by the Board at B.31.

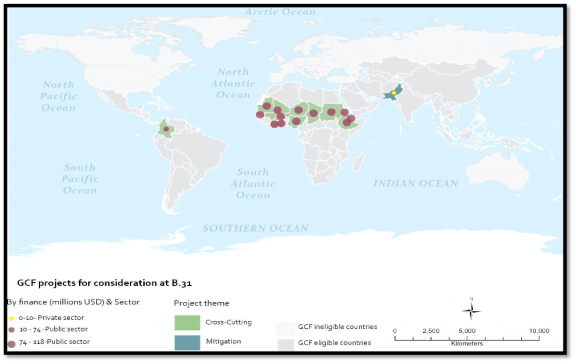

Of the three projects being proposed, two are from the public sector and one from the private sector. If all three were to be approved, the GCF will have a total of 193 projects/ programmes in its portfolio, activating an additional USD 200.6 million worth of investments for the green initiatives that cover fifteen countries across three continents. This would raise the GCF’s portfolio in climate finance to USD 37.4 billion with co-financing, and to USD 10.2 billion just counting its standalone share. A major share of the investments for the three projects is being directed towards Africa at 58 per cent, with the remaining 42 per cent directed towards Latin America and the Asia-Pacific. As shown in Figure 1, none of the projects being proposed comes from the Small Island Developing States (SIDS) this time. The SIDS already had a less share in the overall GCF portfolio with only 45 approved projects. The projects on the table for the Board’s consideration at B.31 claim the potential to capture 15.6 million tonnes of carbon dioxide equivalent (CO2eq) of greenhouse gases and to benefit 3.8 million people across the regions. A simple summary of the projects is listed below¹.

| Funding Proposal No. | Project name | Countries concerned | Public/Private | GCF funding (USD mi.) |

|---|---|---|---|---|

| FP182 | Climate-smart initiatives for climate change adaptation and sustainability in prioritized agricultural production systems in Colombia (CSICAP) | (single) Colombia | Public | 73.3 |

| FP183 | Inclusive Green Financing Initiative (IGREENFIN I): Greening Agricultural Banks & the Financial Sector to Foster Climate Resilient, Low Emission Smallholder Agriculture in the Great Green Wall (GGW) countries - Phase I | (multi) Burkina Faso, Chad, Côte d'Ivoire, Djibouti, Eritrea, Ethiopia, Ghana, Mali, Mauritania, Niger, Nigeria, Senegal, Sudan | Public | 117.3 |

| SAP024 | Pakistan Distributed Solar Project | (single) Pakistan | Private | 10.0 |

Figure 1 – Distribution of countries eligible for GCF funding and the projects to be considered at B. 31 with approved funding by sector and project theme

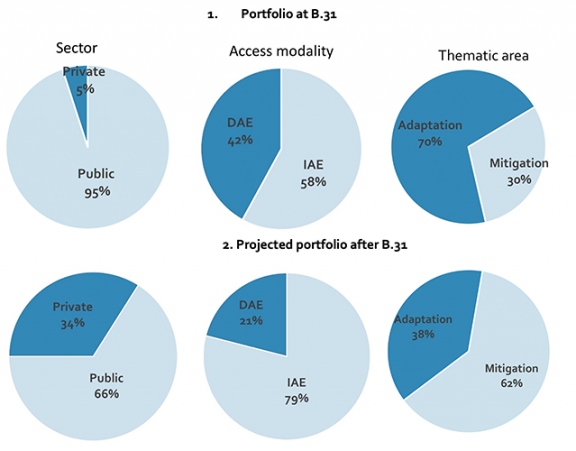

The three projects would raise the Fund’s overall adaptation share to 49 per cent and mitigation to 51 per cent in grant equivalent terms, a welcome sign concerning the GCF’s mission to achieve a 50:50 balance in its portfolio between mitigation and adaptation. In nominal terms, however, the Fund’s overall portfolio is inclined more towards mitigation with 61 projects accessing 62 per cent of the total share and adaptation with 82 projects accessing only 38 per cent of the total funding (Figure 2). The small size of the adaptation portfolio in nominal terms is a matter of concern, also reflected in the IEU’s Independent Evaluation of the Adaptation Portfolio and Approach of the GCF. This evaluation found that the GCF’s adaptation portfolio consists of very few programmes (4 programmes out of 67 adaptation proposals until the end of 2020) and mostly small-size single country projects. Further, the evaluation points out that the GCF’s lack of a clear programming approach for adaptation could be the reason behind the relatively weaker growth of GCF’s adaptation portfolio in comparison to the cumulative growth of its mitigation portfolio. Projects with adaptation goals can help reduce the adverse impacts of climate hazards in advance, and therefore, they should have equal space in climate finance.

The GCF’s adaptation projects receive funds mostly through the international accredited entities (IAEs) around 82 per cent and a few of them through the national or regional direct access entities (DAE). Among the DAEs, regional entities have limited presence in the Fund’s overall portfolio and in particular in the GCF’s adaptation portfolio. Although more than half of GCF’s accredited entities (AE) are DAEs, still a smaller number of projects/climate initiatives are being channelled through them. The IEU’s SPR Synthesis Study (2022) states that timing issues, weak capacities and country preferences contribute to the imbalance in the portfolio of FPs undertaken by DAEs. The IEU’s Accreditation synthesis (2020) also states that engagement of DAEs can be improved by matching them with experienced IAEs that can help them build their capacities and provide support in the overall process. The DAEs have the potential of serving as key drivers in bringing a paradigm shift because of their effective and sustainable presence on the ground.

Figure 2 – GCF portfolio by sector, access modality, and thematic area in nominal USD percent for the 1) three funding proposals (FPs) and 2) the GCF’s projected portfolio if the three FPs are to be approved at B.31

Source: GCF/B.31/02, March 2022. Analysis by IEU DataLab.

The private sector could be another player that can speed up achieving the climate goals, although its share in B. 31 remains meagre, with only 5 per cent compared to the public sector share (95 per cent) and 34 per cent in the overall GCF portfolio. This indicates that the Fund’s efforts in enhancing participation from the private sector, especially from local actors, have significant gaps in terms of its process and the approach. According to the IEU’s Independent Evaluation of the GCF’s Private Sector Approach (2021), this limited private sector presence in the overall GCF portfolio is mainly due to the Fund’s lengthy project approval timeline, limited risk tolerance, and the lack of a country-driven approach especially when it comes to aligning national climate strategies with private sector projects. To catalyze the engagement of private sector actors in climate finance, a few operational and process updates are required. In this context, it is crucial for the GCF Board to discuss and build momentum for a strengthened private sector strategy for the Fund.

I hope that B.31, the first Board meeting to take place in 2022, will see the Board successful in approving the funding proposals and actively discussing ways to ensure more strategic investments.

References

¹ This information is up to date as of 22 March 2022.

² Dr. Swati Saini joined the IEU in November 2021.

Disclaimer: The views expressed in blogs are the author's own and do not necessarily reflect the views of the Independent Evaluation Unit of the Green Climate Fund.