Climate impact bonds and the GCF

How would you react if someone says they could reduce greenhouse gases, protect social goods such as ecosystems, ensure a fair deal for everyone, get oil companies to switch to renewable energy, and attract investors?

“Great,” you’d say, “But impossible!”

Actually, it’s not impossible at all.

One way of doing it is through impact bonds. Climate impact bonds in particular.

Development and social impact bonds can have diverse development applications and are changing the way we think about social goods.

So, how do Impact Bonds work?

Most impact bonds feature some or all of the following characteristics.

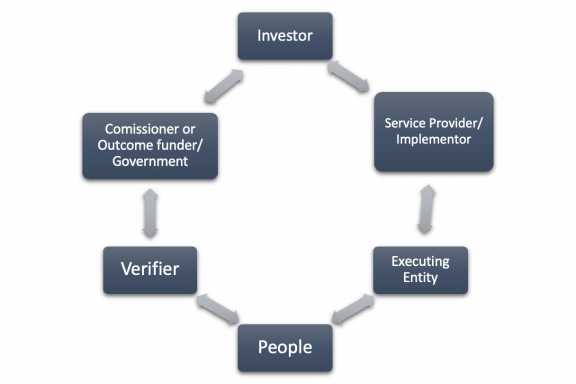

- A government (or an outcome payer such as a philanthropic foundation or social enterprise) decides that they would like to see a particular social, environmental, or climate outcome AND is willing to pay for it.

- An investor decides these outcomes are useful and important to pursue above and beyond making a financial gain.

- Working with a government that supports the investor’s vision, a contract is drawn up that lays out what the government is willing to pay IF the social, environmental, or climate outcomes are achieved.

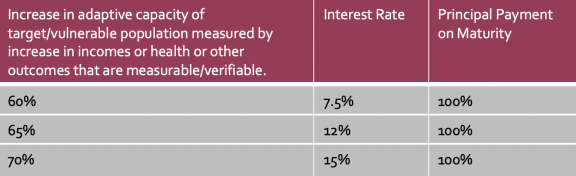

- Usually, this contract has a payment schedule: For example, if 65% of the outcomes are achieved, the government will pay the investor the full principal. If 70% is achieved, the government will pay a 7.5% return on the principal; if 85%, perhaps a 10% return, and so on.

- Once the investor and government sign a contract, the investor procures a service provider capable of implementing the project on the ground. The investor and the service provider sign a separate contract that lays out what results will be achieved, with the investor paying for the service provider’s work.

- The government contracts and pays an external evaluator to measure the service provider’s work. Methods of measuring and types of outcomes are discussed between the government, the investor, and the evaluator.

- The service provider then implements the project. If the intended results are achieved, as verified by the evaluator, the investor gets paid by the government. If the results are not achieved, the investor is not paid.

This arrangement has now been tried for a range of social goals or public goods all over the world, including reducing the number of foster children, reducing recidivism, increasing the number of rhinoceroses, and providing education services.

What are we learning from impact bonds?

These results-based payments have captured the imagination of many. However, getting investors interested in results-based investment opportunities remains challenging.

Nevertheless, while impact bonds remain nascent, the International Finance Corporation is forecasting the impact bonds industry will be around $23 trillion by 2030. But if impact investing is to succeed, it is important that:

- Impacts are measurable

- Impact outcomes, not outputs are measured

- Impact measurement is conducted using non-standard approaches

- Impact measurement is not too costly for investors

The opportunity for climate

Despite these challenges, an opportunity exists for ‘climate impact bonds’ or bonds that also achieve climate change and resilience-related impacts along with financial returns. A possible contract between an investor and an outcome payer could look like this:

This can also be adapted to reducing greenhouse gases, as occurs with green bonds for protecting a forest ecosystem, or blue bonds for protecting a marine area.

Certain conditions must be met to make climate impact bonds successful.

- Impact measured needs to be attributable to the intervention. This means that impact needs to be attributed or caused by the investment and it needs to show that the changes wouldn’t have occurred without the investment.

- There needs to be third party verification and measurement. This verifier/evaluator must have evaluation skills and be able to measure changes in an independent and unbiased way.

- Contracts and coordination must be effectively delivered. Evaluators need to be able to assess the incentives for each actor are aligned in what is often a complicated arrangement.

- The overall objectives of the investment are to achieve results. This means that data systems and analytical systems need to unbiased, independent and established early on.

Have questions or comments about this blog? Join the conversation on Twitter with the hashtag #IEUBlog

Disclaimer: The views expressed in blogs are the authors' own and do not necessarily reflect the views of the Independent Evaluation Unit of the Green Climate Fund.