B.33 Data Outlook: Funding proposals for Board’s consideration

From 17 to 20 July 2022, the 33rd GCF board meeting (B.33) will take place in Incheon, South Korea. This will be the first GCF Board meeting that I observe as a member of the GCF family, as I joined the Fund’s Independent Evaluation Unit (IEU) as an Evaluation Specialist in May 2022. It is heartening to see the reconvening of Board members and Secretariat colleagues in person in the GCF-host country for the first time since the outbreak of COVID-19. Four funding proposals will be presented at B.33 for the Board’s approval. The four proposals are as below:

Table 1: Funding proposals to be tabled at B.33

| FP Number | Project Name | Accredited Entity | Thematic Window | GCF Funding (in USD million) |

|---|---|---|---|---|

| FP187 | Ouémé Basin Climate Resilience Initiative (OCRI) Benin | FAO | Cross-cutting | 18.5 |

| FP188 | Climate Resilient Fishery Initiative for Livelihood Improvement in the Gambia (PROREFISH Gambia) | FAO | Cross-cutting | 17.2 |

| FP189 | E-Mobility Program for Sustainable Cities in Latin America and the Caribbean | IDB | Cross-cutting | 200 |

| FP190 | Climate Investor Two | FMO | Cross-cutting | 145 |

Below is a map highlighting the spread of countries for these four FPs concerned.

Map 1: Spread of additional financing for the B.33 FPs concerned

Continued dominance of IAEs in GCF portfolio

All four proposals being tabled at B.33 pertain to the international accredited entities (IAEs). If these proposals are approved, the share of IAEs in total GCF’s nominal financing will go up further. If approved, in nominal terms, the IAEs would have cumulatively received USD 8.7 billion for 156 projects, which represents 81 per cent of total GCF finance. The remaining 19 per cent, or USD 2.1 billion, will be channeled to direct access entities (DAEs) for 44 projects. In grant equivalent terms, the share of financing to DAEs is expected to go down marginally from 18 per cent to 17 per cent, while that of IAEs is expected to go up from 81 per cent to 83 per cent. This increase is because there are no DAE projects in the current cohort. The IAEs will have 78 per cent of the 200 projects that would be approved, while the DAEs will only have 22 per cent of the total number of projects at the end of B.33.

The IEU’s SPR Synthesis Study (2022) states that timing issues, weak capacities, and country preferences contribute to the imbalance in the portfolio of funding proposals undertaken by the DAEs. The IEU’s Accreditation synthesis (2020) also states that the engagement of DAEs can be improved by matching them with experienced IAEs that can potentially help them build their capacities and provide support in the overall GCF process. Such "twinning” is also expected to enhance DAEs’ ability to propose concept notes for the GCF and build their capacity in programme management. To incentivize such collaboration, the evaluation recommends that appropriate incentives be provided to DAEs through readiness grants and to IAEs through the inclusion of such requirements in reaccreditation conditions.

No change in the thematic composition of GCF portfolio

The GCF’s portfolio remains skewed in favour of mitigation. As of B.32, in nominal terms, USD 6.5 billion (62 per cent) was allocated for mitigation projects and USD 4 billion (38 per cent) for adaptation projects. If all four ‘cross-cutting’ proposals are approved at B.33, the share of finance will remain the same with the GCF’s overall mitigation projects accounting for USD 6.7 billion (62 per cent) and the overall adaptation projects accounting for USD 4.1 billion (38 per cent). The projected grant equivalent financing to adaptation is expected to remain unchanged at 49 per cent as compared to 51 per cent for mitigation.

The continued smaller allocation to the adaptation portfolio in nominal terms is a matter of concern, also reflected in the IEU’s Adaptation evaluation. The evaluation points out that the GCF’s lack of a clear programmatic approach for adaptation could be a reason behind the relatively weaker growth of GCF’s adaptation portfolio in comparison to the cumulative growth of its mitigation portfolio.

Composition of funding by financial instrument

As of B.32, the largest portion of the portfolio was financed by loans (43 per cent), followed by grants (41 per cent), equity (9 per cent), results-based payments (5 per cent), and guarantees (2 per cent). With 68 per cent of the nominal funding in the new funding proposals going towards grants, the financing share of grants in the overall GCF portfolio will slightly increase to 42 per cent and loans will go down slightly (42 per cent or USD 4.5 billion). Shares of equity, results-based payments, and guarantees will remain the same as of B.32.

Share of financing by region and proportionate impact on adaptation and mitigation

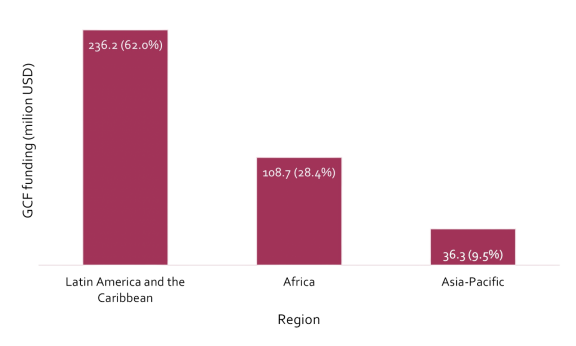

If the current set of proposals is approved by the Board at B.33, the biggest beneficiary region in terms of increase in financing in absolute terms would be Latin America and the Caribbean (LAC). As shown in Graph 1 below, LAC is expected to receive USD 236.2 million, while Asia and the Pacific receive USD 36.3 million, and Africa USD 108.7 million in additional financing.

Graph 1: Regional share of additional financing for the B.33 FPs concerned

While LAC is expected to get the biggest share of funding, projects in Africa are still expected to add the most in terms of absolute impact in both adaptation and mitigation. If all four proposals are approved at B.33, the projects in Africa are expected to reduce an additional 12.9 million tonnes of CO2, as compared to 10.7 million tonnes of CO2 in LAC. Similarly, in terms of adaptation, the new proposals are expected to reach additional 27.9 million people in Africa, as compared to 14.6 million people in LAC.

I hope B.33 will be productive and will contribute to enhancing the GCF’s ability to finance paradigm-shifting projects.

Disclaimer: This guest blog was originally published by the author. The views expressed in this guest blog are the author's own and do not necessarily reflect the views of the Independent Evaluation Unit of the Green Climate Fund.